As an NRI, you might have to go through a continuous bout of stress when it comes to choosing between multiple services for deciding about your savings and investments. So here is a quick guide to your bank account options as NRIs for money management back home:

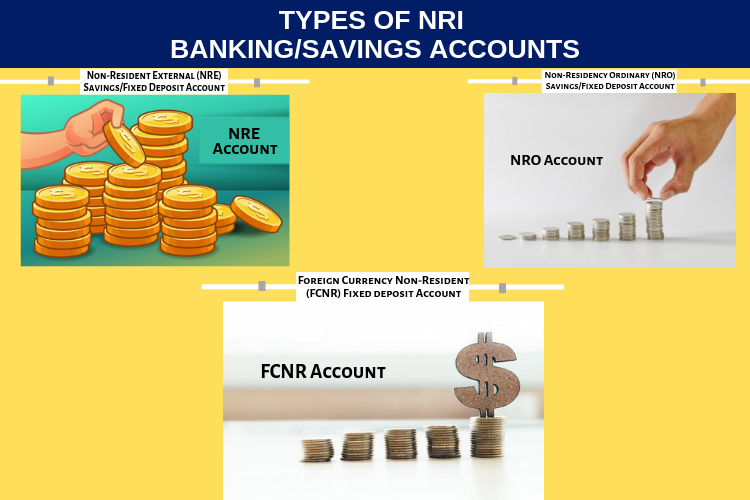

There are various types of NRI accounts that are available to an NRI Investor. Some of the major ones are:

1. Non-Resident Ordinary (NRO) Savings Account/ Fixed Deposit Account

It is a Savings/Current bank account held in India, in Indian Rupees. The NRO account is best suited for you if you have earnings in India or abroad. As money from an NRO account is non-repatriable i.e., non-transferable in the normal course and is ideally used to support local spends. Interest income earned on the amount in an NRO Account is liable for TDS or Tax Deductible at Source. You can have other NRIs or resident Indians as joint account holders on NRO Accounts.

2. NRE Savings Account /Fixed Deposit Account

These are rupee-denominated accounts and can be in the form of savings, current, recurring or fixed deposit accounts. NRE Accounts are maintained in rupees, but allow restricted sources of credit like overseas remittances or transfers from your NRE or foreign accounts. It is mainly used to house your savings from income that you have earned abroad. The principal amount, as well as the interest, are fully repatriable, also the interest income earned on the amount in an NRE account is non-taxable in India.

3. Foreign Currency Non-Resident (FCNR) Accounts

These are fixed deposits that can only be maintained in foreign currencies. The deposits are for periods ranging 1 to 5 years and the interest earned on them is protected from exchange rate fluctuations since it is maintained in your foreign currency of choice. The principal amount and the interest in an FCNR Account are fully repatriable and are non-taxable in India.

The information provided in this article is generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. We strongly recommend you to seek professional help pertaining to your queries and doubts.